What is consumer revolving credit?

v1.0

Revolving credit is a type of credit where the maximum amount that can be borrowed is fixed, however, the borrower doesn’t have a fixed number of payments on the loan. Instead amounts can be withdrawn up to the maximum amount and then repaid and withdrawn again until the credit term expires. The federal reserve reports the total amount of consumer revolving credit in this series:

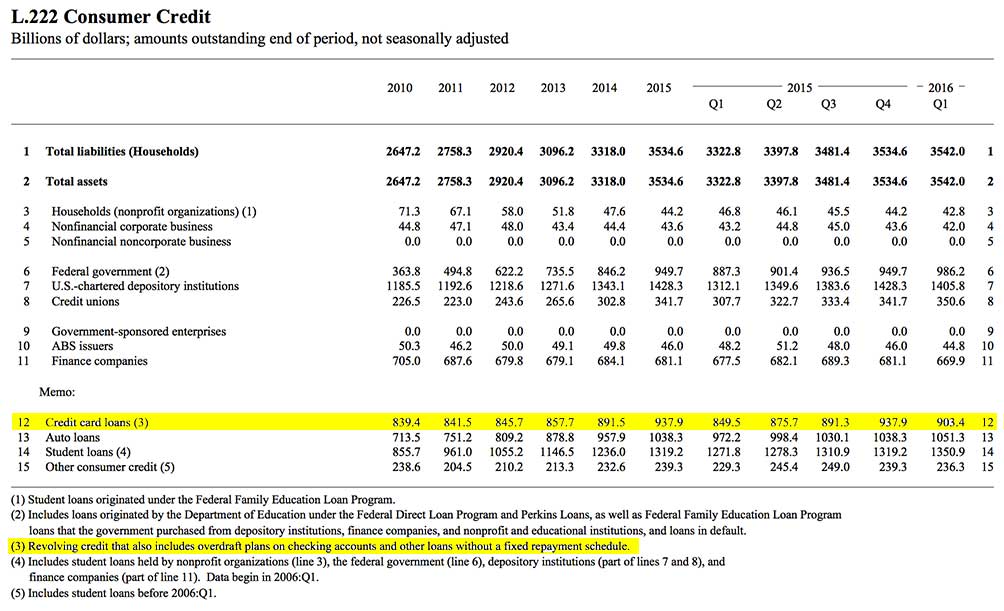

A portion of the revolving credit is credit cards which can be found in this series:

The remaininder includes overdraft plans on checking accounts and other loans without a fixed repayment schedule according to the Fed’s Z.1 report, specifically:

Written on August 26, 2016